By Daniel James, Director – Daniel James Residential LTD

Dear reader,

Welcome to the Daniel James Spring 2025 newsletter – your trusted source for insight, trends, and analysis from the ever-evolving UK housing market.

By the end of this review, you’ll be fully informed about everything that has shaped the property landscape over the past quarter – from stamp duty deadlines to buyer demand, mortgage markets, and price movements. This post is designed to help buyers, sellers, landlords, and investors make informed decisions.

🌸 The Stamp Duty Deadline: What Just Happened?

March 2025 saw an extraordinary surge in property transactions, with 52,653 completions in the final week before the stamp duty relief ended on 1st April. This represented a 92% increase compared to a typical Q1 week. For context, the weekly average this quarter stood at 27,458, meaning March alone accounted for a major portion of Q1 transactions.

As the nil-rate band for stamp duty returned to pre-COVID levels, the change has had a broad impact:

- 83% of homeowners will now pay stamp duty (vs. 49% pre-April)

- First-time buyers paying stamp duty jumped from 21% to 42%

- Costs rose by up to £11,250 depending on purchase price

While this may feel like a blow, it’s important to recognise that these changes are simply a return to pre-pandemic norms. The increases were widely expected and many buyers factored them into their budgets in advance.

📈 Q1 Market Activity Overview

📊 Q1 2025 vs Q1 2024 Activity Metrics

Despite the deadline, the property market held firm:

- Properties For Sale: +7.67%

- New Listings: +3.23%

- Relisted Homes: +23.58%

- Sales Agreed: +14.60%

- Price Changes: +19.05%

- Withdrawals: -22.81%

This shows strong supply and demand – with motivated buyers and sellers continuing to engage despite the higher cost of moving.

“Confidence to move remains high – but pricing strategies must be realistic.” – Daniel James

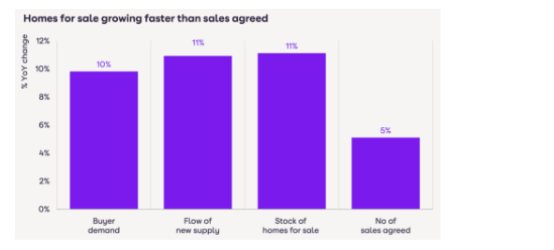

Buyers have had the widest choice of homes since 2013, and they have kept asking price inflation in check. Notably, while asking prices rose by 5.33%, the prices of homes going under offer dropped by 1.88%, indicating a gap between expectation and reality.

💷 Interest Rates, Mortgages & Affordability

📊 Fixed Mortgage Rate Trends & Mortgage Approvals

Interest rates are stabilising:

- 2-Year Fixed Average: 4.87%

- 5-Year Fixed Average: 4.73%

- Lowest Fixed Deals: Between 3.86%–3.96%

While rates are lower than their 2023 peak (6.11%), they’re still historically high. Yet, mortgage approvals remain strong:

- February Approvals: -1.06% month-on-month

- Year-on-Year: +8.26%

- 12-Month Average: +2.46%

- Only 2.52% below 10-year average

This resilience shows a housing market that’s learning to operate confidently with base interest rates that start with a 4.

Lenders are also adapting:

- Santander lowered affordability stress rates by up to 0.75%

- Accord Mortgages is offering £6,250 cashback for first-time buyers

- Skipton launched a 1.5% cashback incentive for those missing the deadline

🏘️ Transactions & House Price Forecasts

📊 10-Year Transaction Trend Line

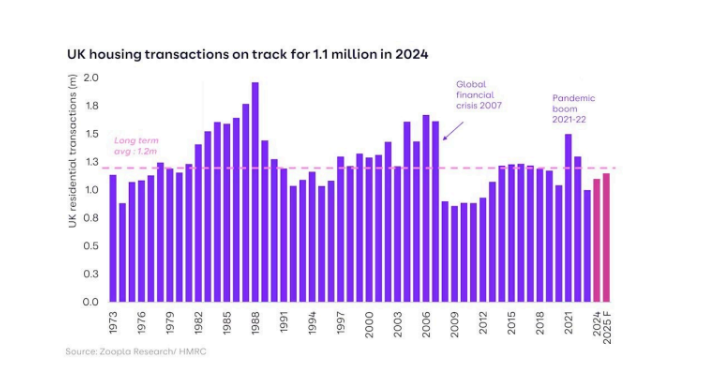

UK residential transactions surged:

- February 2025: +28.73% YoY, +13.82% MoM

- April–Feb FY Comparison: +14.12%

- OBR Forecast (2024–2029): Transactions to rise to 370,000 per quarter

More homes are changing hands, supported by improved planning regulations and new housing stock. The UK is forecast to build 305,000 homes per year, reaching a 40-year high in housing delivery.

House price trends:

- 2025 Growth Forecast: +2.8%

- 2029 Forecast: ~£295,000 average UK house price

- Stock Growth: +0.5% = -0.8% price impact (supply vs demand balance)

🧾 Currency, Economics & Affordability

📊 : GBP-EUR/USD Trends & Inflation Tracker

Headline inflation is easing, sitting at 2.8% in February, and while interest rates may remain steady in the short term, the market appears well-prepared.

Affordability is improving:

- Median home cost 7.7x earnings in England (2024), vs 8.5x peak

- Earnings up 20% since 2021 vs 1% house price growth

- 58% of home purchases funded by equity/cash

The most common LTV is 75%, and 50% of mortgages are now over 30 years, helping with affordability.

🧠 What It All Means

Despite political shifts, economic uncertainty, and rising costs – confidence is growing. Sentiment has improved since October 2024, with:

- Confidence in the housing market at 30%, up from 24% in January

- Buyers getting smarter, and more flexible with size, location and budget

- Sellers becoming more realistic – and those who price right are succeeding

We anticipate a stronger-than-expected summer and continued demand, especially from first-time and needs-based buyers.

✅ Daniel’s Takeaway: Advice for 2025 Sellers

📋 : Top Tips for Selling in a High-Choice Market

- Price strategically – Overpricing risks long market times

- Offer value – Make your home stand out with presentation and photography

- Work with a proactive agent – Marketing, negotiation and buyer follow-up matter now more than ever

- Act confidently – Buyers are out there, and the right strategy will get results

Thank you for reading.

Whether you’re thinking of buying, selling, investing, or simply staying informed, our team at Daniel James Residential LTD is here to help guide you through every market movement with clarity and care.

Warm regards,

Daniel James

Director – Daniel James Residential LTD

https://www.facebook.com/Danieljamesresidential FOLLOW US ON FACEBOOK

Daniel James Spring 2025 newsletter – Thank you for reading

https://www.danieljamesresidential.com/properties OUR LATEST HOMES